The Federal Budget handed down last night by the Treasurer

Josh Frydenberg has generally been agreed to be a responsible Budget.

It claims to be the first Budget in 12 years to deliver a surplus although a

forecast of a $7 billion surplus for the 2019-2020 year is hardly significant

where the GDP is about $1.8 trillion.

With forecast tax cuts for around 10 million people and promises for large

amounts of spending on infrastructure, schools, healthcare, science and

medicine, this Budget does lay a platform for the election campaign.

The most relevant changes as to how the Budget will affect you are as follows:

Personal Tax

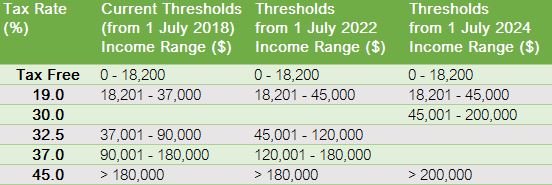

Between now and the 2024/25 tax year there will be substantial changes to the personal marginal tax rates.

Low and Middle Income Tax Offset (LMITO)

The Government announced that they would introduce a low and middle income tax offset that would operate between the 2019 and 2022 tax years only to provide some tax relief for those who earn up to $126,000. This tax offset is a non refundable tax offset meaning that it is a use it or lose it tax offset. For taxpayers earning $37,000 or less the LMITO will be $255. The LMITO will increase at a rate of 7.5% for every dollar of taxable income above $37,000 and will be capped at $1,080 (which is equal to a taxable income of $48,000). The maximum LMITO of $1,080 will be available to all taxpayers with a taxable income of between $48,000 and $90,000.

Superannuation

The good news is that there is very little in the Budget in relation to superannuation changes. This is a good thing given the significant changes that took affect on 1 July 2017.

Under this Budget the Government is proposing to allow those aged 65 and 66 to make concessional and non-concessional superannuation contributions without meeting the work test from 1 July 2020. More significantly those aged 65 and 66 will also be able to utilise the bring forward rule to make up to three years of non concessional contributions. This is a significant change and not only allows you to get more into superannuation in the early stages of retirement but offers the opportunity to take advantage of the withdrawal and recontribution strategy to equalise superannuation as between partners/couples, alter the tax components of your existing superannuation monies and manage couples transfer balance caps and total super balances.

Division 7A- Private Company Loans to Shareholders

As you may have seen from our newsletter in late January 2019, Treasury put out a consultation paper setting out proposed changes to the operation of Division 7A of the Income Tax Assessment Act. These proposed changes were significant and most of the changes favoured revenue collection. The Government announced last night that the proposed Division 7A changes would be deferred for 12 months. This usually means that the feedback to the consultation paper was extremely negative (as it should have been) and further work is required before finalising any changes to go before the houses of Parliament.

Small to Medium Businesses

The Government is to increase the instant asset write off from $25,000 to $30,000 with effect from 2 April 2019. The instant asset write off will be available to small businesses with aggregated turnover of less than $10.0m where the business purchases an eligible asset costing less than $30,000 that are first used or installed ready for use from 2 April 2019 to 30 June 2020.

The Government has also extended this to medium sized businesses. A medium sized business is defined to include any business with an aggregated turnover of $10.0m or more but less than $50m.

This can be useful where a business is looking to spend money on capital items as it could provide some cash flow advantages in the short term. The cash flow advantage would occur where a business finances the acquisition of the capital equipment and then amends the company’s PAYG quarterly income instalments and/or reduces its final annual tax liability.

This can be useful where a business is looking to spend money on capital items as it could provide some cash flow advantages in the short term. The cash flow advantage would occur where a business finances the acquisition of the capital equipment and then amends the company’s PAYG quarterly income instalments and/or reduces its final annual tax liability.

The comments are closed.