The Government announced personal tax cuts in the Federal Budget together with a number of integrity measures. Tax cuts will phase in over 7 years and will culminate in the reduction of tax brackets from 5 to 4.

1. Income Tax Rates

The government has stated that they will keep taxes as a share of GDP within the 23.9% cap. As a consequence the Government announced the following changes to the individual tax brackets:

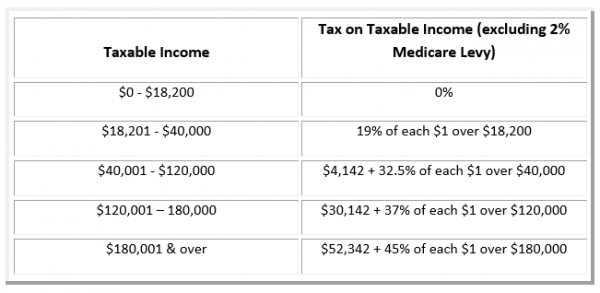

2018-19 Tax Year to 2021-22 Tax Year

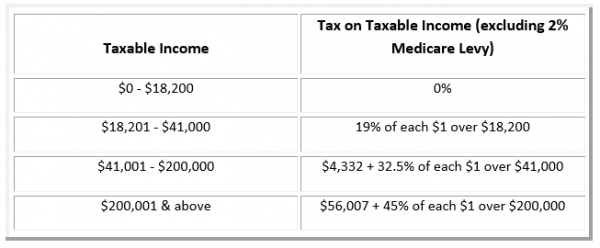

2022-23 Tax Year to 2023-24 Tax Year

2024-25 Tax Year and Beyond

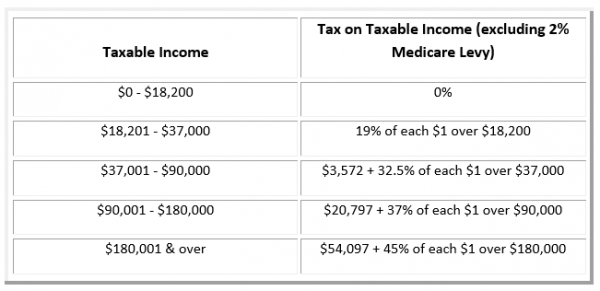

2024-25 Tax Year and Beyond

For the 2018/19 tax year through to the 2021/22 tax year, middle and low income earners will be able to access a new tax offset of up to $530 per person per annum. This in addition to the existing Low Income Tax Offset currently available of up to $445.

From 2022/23 tax year the Low Income Tax Offset will be increased from $445 to $645.

2. Medicare Levy Thresholds

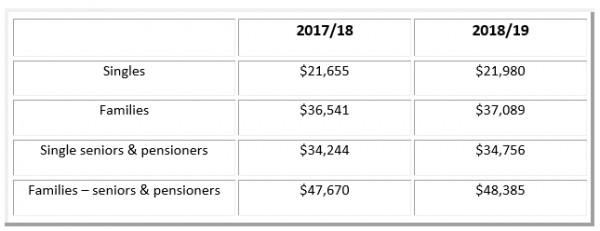

The Government will increase the Medicare Levy low-income thresholds as follows:

For each dependent child or student, the family thresholds increase by a further $3,406 (compared to $3,356 in 2017/18 tax year).

3. Taxation of Testamentary Trusts

A testamentary trust is created through a deceased’s will. While there has been much debate over whether or not you can add to the assets of a testamentary trust with non-estate monies the Government announced a taxation integrity measure to ensure that minors will only receive the benefit of the adult tax rates in respect to income that a testamentary trust derives from assets of the deceased asset.

4. Taxation of Income for an individual’s fame or image

As of 1 July 2019 high profile individuals such as sportspersons and actors will no longer be able to divert earnings from the use of their fame or image to another entity. That is, all marketing and promotional income will be taxed in their hands and will no longer be able to be diverted to another entity.

If you would like further information regarding how the Federal Budget will impact you please contact the office 03 9629 1433

The comments are closed.