2020 will be a year none of us forget and everybody’s attention has been on lockdown rules, number of infections and their daily movements, stock market volatility and the value of your superannuation. All of these things have been at front of mind because they have been important to you. One thing that we must not forget is to ensure that we are not paying more tax than we should be paying. Below is a list of things that you should take into account to ensure that your financial affairs are as tax effective as possible before 30 June 2020.

1. Capital Gains

A capital gain occurs where you sell an asset for more than you paid. That capital gain is the offset against any carried forward capital losses you may have incurred in prior tax years and any current year capital losses that you have realised. If your capital gains are greater than the combined current year capital losses and the carried forward capital losses then the net capital gain is included in your income tax return. If you have owned the asset for more than 12 months, the capital gain (after offsetting any capital losses) will be subject to a 50% discount such that only 50% of the capital gain will be included in your assessable income and be subject to tax.

If you have realised any capital gains during the 2020 tax year, you should review your asset holdings to assess whether you have any capital losses that could be realised through the sale of those assets prior to 30 June 2020 which will enable you to reduce your net capital gain.

Importantly, for most assets (e.g. real estate, shares etc) the date that determines the year in which the capital gain (loss) falls is the contract date and not the date you settle the transaction. That is, if you signed a contract to sell a property on 5 June 2020 but it did not settle until 5 September 2020, the capital gain will fall in the 2020 tax year (not the 2021 tax year) as this is the tax year during which you signed the contract to sell the asset. Settlement is merely the date upon which payment is due to be made.

We recommend that you review your capital gains tax position now and, if you have realised capital gains, assess whether you are holding any assets that could enable you to realise a capital loss so that you could offset the capital gain.

Importantly, the ATO do not look favourably on certain transactions where a taxpayer crystalises a capital loss but still maintains the economic interest in the asset. Typically this would be a situation when a person sells and asset to a partner/spouse/relative in order to realise the lose in their name but effectively retains control of the asset. If you have your own self managed superannuation fund (SMSF) you could consider making an in-specie concessional or non-concessional contribution through transferring the asset to your SMSF (subject to being permitted to do so under the SMSF’s trust deed). Further, the asset being transferred to your SMSF must be an asset that your SMSF is allowed to acquire from a related party. We recommend that you contact our office to discuss this before proceeding.

2. Concessional Superannuation Contributions

Since 1 July 2017 all taxpayers are now allowed to claim a tax deduction for concessional superannuation contributions. Previous to 1 July 2017 the only way most employees could use superannuation contributions to improve their tax efficiency was through a salary sacrifice arrangement with their employer.

If you have sufficient cash flow you could consider maximising your superannuation contributions for 2020. Each person under the age of 75 has a concessional contribution cap of $25,000. If you contribute more than the $25,000 cap limit, the excess is subject to excess contributions tax (i.e. the excess is taxed at your effective marginal tax rate). Why would you want to make a contribution to superannuation and lock your money away until retirement? The answer is tax efficiency. If you make a personal contribution to your superannuation fund and you claim a tax deduction for the amount contributed you are getting a tax deduction at your highest marginal tax rate compared to the 15% contributions tax paid by your superannuation fund on the contribution.

For example, Brett is earning $120,000 and his employer will have contributed $11,400 to his nominated superannuation fund prior to 30 June 2020. Brett’s annual concessional contributions cap is $25,000. If Brett has the ability to contribute, Brett could contribute up to $13,600 prior to 30 June 2020. His personal tax saving by making this additional contribution would be $5,304 (being $13,600 x 39% [i.e. his marginal tax rate of 37% plus Medicare Levy of 2%]). The contribution of $13,600 is taxed as a concessional contribution in his superannuation fund at 15% or $2,040. Brett’s net tax saving is $3,264 (being his personal tax saving of $5,304 less the tax the superannuation fund has to pay on the contribution of $2,040). In terms of return on investment, the net tax saving produces a return of 24%.

Depending on your taxable income the net tax benefit from making a superannuation contribution will be as follows:

Taxable income less than $18,200 -15.0%

Taxable income between $18,200 and $37,000 6.0%

Taxable income between $37,000 and $90,000 19.5%

Taxable income between $90,000 and $180,000 24.0%

For taxpayers with income of greater than $180,000, the net tax benefit will be determined by your “Division 293 Income” plus your “Division 293 Super Contributions”. Generally, your Division 293 Income includes your taxable income plus reportable fringe benefits plus net financial investment losses plus net rental property losses plus the net amount on which family trust distribution tax has been paid. Your Division 293 Super Contributions equal your concessional contributions less any excess concessional contributions. The net tax benefit where your Division 293 Income plus your Division 293 Super Contributions is:

Between $180,000 and $250,000 32.0%

Greater than $250,000 17.0%

3. Work Related Tax Deductions

a. Home Office Expenses

For 2020 there are two components to working out your home office expenses. There are rules that apply pre COVID-19 and then rules applying where you have had to work from home due to the COVID-19 lockdown restrictions.

- Home office expenses that you can claim include:

- Electricity expenses associated with heating, cooling and lighting the area you are working in and the costs associated with running items (such as computers) that you require to perform your work duties

- Cleaning costs for a dedicated work area

- Phone and internet expenses

- Computer consumables (e.g. paper for the printer, ink cartridges, computer cables etc)

- Stationery

- Depreciation of home office equipment (e.g. computers, printers, phones, furniture, furnishings etc). If the item is less than $300, you can claim the full amount as a deduction in the 2020 tax return subject to apportionment between work usage and personal usage.

Firstly, where you have had to work from home during the COVID-19 lockdown period the ATO will permit you to calculate your home office deduction between 1 March 2020 and 30 June 2020 using one of three methods. The first is a simplified method and is based on claiming your home office expenses at a rate of $0.80 per work hour. If you claimed home office expenses for the 4 months from 1 March 2020 to 30 June 2020 on the basis of 7.5 hours per working day then the claim would be $510 (being 85 business days in the period x 7.5 hours per day x $0.80). Under this “shortcut method” you must keep a record of the number of hours you worked at home (e.g. timesheets or diary notes)

The second method which the ATO refer to as the “fixed rate method” allows you to claim the following:

+ $0.52 per work hour for heating, cooling, lighting, cleaning and depreciation of office furniture; plus

+ the work related portion of your actual costs of phone and internet expenses, computer consumables and stationery; plus

+ the work related portion of the depreciation of your computer, laptop or similar device

The third method is referred to the actual cost method. Under this method you are able to claim the actual work related portion of all of the above mentioned expenses. The calculation must be made on a reasonable basis.

Under the fixed rate method and the actual cost method you must keep a record of the number of hours you worked from home together with a record of the expenses incurred and the proportion being claimed. For completeness, you should also keep a note on how you have apportioned expenses between work and private.

If claiming home office expenses between 1 July 2019 and 29 February 2020 you are able to base your claim on either the fixed rate method or the actual cost method as stated above. Under the substantiation rules if you use the fixed rate method the ATO require you to keep records of either your actual hours spent working at home for the year or a diary for a representative 4 week period to show your usual pattern of working at home. Under the fixed rate method you also need to keep a record of how you have calculated phone/internet usage, computer consumables & stationary usage and deductible portion of depreciation claimed on computers, printers or other equipment.

The actual cost method requires you to maintain a lot of information and for most the requirements are too onerous. As such, we would recommend using the fixed rate method over the actual rate method. However, if you prefer to use the actual rate method we would recommend that you contact our office to discuss the requirements.

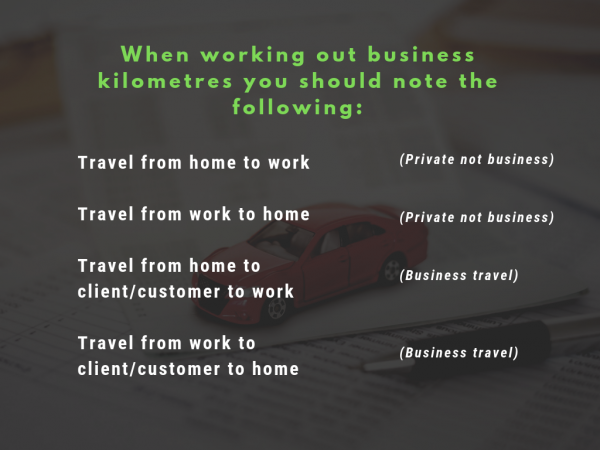

b. Motor Vehicle Expenses

- If you claim up to 5000 business travel kilometres at a set rate of $0.68 per kilometre. The maximum deduction is $3400. Under the cents per kilometre method you do not need written evidence to show how many kilometres you travelled but, if asked by the ATO, you must be able to justify how you worked out the number of kilometres travelled. Therefore, we suggest you hold a file note setting out how you calculated the number of kilometres travelled.

- If you wish to claim actual motor vehicle expenses incurred you must maintain a log book. The log book must be maintained for 12 consecutive weeks within the tax year and must be representative of your normal business travel. The business use percentage justified by the log book is then applied to the motor vehicle expenses incurred to determine the deduction.

Under the log book method, you must be able to substantiate all expenses incurred.

Given that we have had a lockdown period restricting movement for the best part of 4 months to the end of June, you should be mindful that you must be able to justify the number of work related kilometres being claimed under the set rate per kilometre method.

As the majority of taxpayers claiming motor vehicle expenses tend to claim under the set rate per kilometre method and in the past the calculation of the number of kilometres being claimed is fairly arbitrary, we urge you to maintain a file note on how you have determined the number of kilometres being claimed as the ATO may increase their compliance focus on motor vehicle expenses for the 2020 tax year.

c. Subscriptions & Memberships

You are able to claim the cost of any memberships or subscriptions that has a direct connection to your occupation. Examples would include membership to any professional organisation, or union and subscription to trade journals.

d. Seminars, Conferences & Education Workshops

You can claim the cost of attending any seminar, conference or education workshop provided that there is a connection or nexus between your employment and the seminar, conference or workshop attended.

If your employer has paid for your attendance then you cannot claim a tax deduction as you did not incur the expense.

e. Clothing, Laundry and Dry-Cleaning Expenses

You can only claim a tax deduction for the cost of buying and cleaning occupation specific clothing, protective clothing and unique or distinctive uniforms. That is, normal everyday clothing will generally not qualify as being tax deductible.

The cost of uniforms or occupation specific clothing must be capable of being substantiated with written evidence demonstrating that you incurred the expense.

The ATO will allow you to claim $1.00 per load if the load is only work-related clothing or $0.50 per load if you include other laundry in the same load. Where you use a dry-cleaning service, you will need to maintain receipts to evidence that your incurred the expense.

4. Prepayment of Expenses

Individual taxpayers are able to claim a deduction for prepaying a deductible expenses. To be eligible to claim a prepaid expense deduction the expenditure must:

a. be deductible in nature; and

b. be prepaid for a period of not more than 12 months with the prepayment period ending before 30 June of the tax year subsequent to the tax year in which the payment is made.

Examples of deductible expenses would be:

- prepaying interest on an investment property loan

- prepaying interest on a margin loan

- paying an annual premium for an income protection policy (as opposed to paying monthly)

- Prepaying for travel, accommodation and registration fees to attend a seminar or conference

- Prepaying accounting fees.

It should also be noted that the prepayment rules do not apply to excluded expenditure that may enable you to claim a full deduction. That is:

- if the expenditure is less and $1000. Examples would include professional membership fees, annual subscription fees to professional/trade journals, etc.

- if the expenditure is required to be made by law or pursuant to a court order. An example would be car registration fees.

If income is likely to be lower this year, you need to ensure that you will maximise the benefit if are to prepay any expenses. If you have a one off income item such as a capital gain then it may be worth considering prepaying expenses to offset the tax implications of a non-recurring income item.

When prepaying expenses, if the expense is an expense that you will incur as a matter of course then consider prepaying. If you are looking for tax deductions to offset one off income items understand that you are incurring the full cost of the expense but you are only getting a tax benefit to the extent of your marginal tax rate. For example, if you are on the top marginal tax rate of 45% and you prepay an expense for $1,000 you are spending $1,000 to save $470 in tax (being $1,000 x [45% marginal tax rate plus 2% Medicare Levy]).

If you would like to discuss any of these matters please do not hesitate to contact either our office on 03 96291433 to discuss.

The comments are closed.