With the release of the Government’s Stimulus Package Retirees may need to review their situation. Have you been wondering what support you will receive or can possibly access as a result of all the changes related to COVID19 as well as the resulting share market declines?

This newsletter aims to outline and clarify the changes announced by Government that aim to support you during these unprecedented times. From the lowering of the Deeming rates on 1 May 2020, or halving of the Account Based Pensions minimum required payment levels, there are a host of support payments being provided to assist people through the next 6 months or so.

While these temporary measures should not mean a total change to your retirement strategy there might be a chance that you now qualify for something – eg. Commonwealth Seniors Health Card or even a partial Age Pension. For those people already on Age pension benefits you should automatically receive the two support payments of $750. For more information please read the newsletter and contact B&W Additions / Bourne & Weir with any questions. Above all stay safe out there and remain connected.

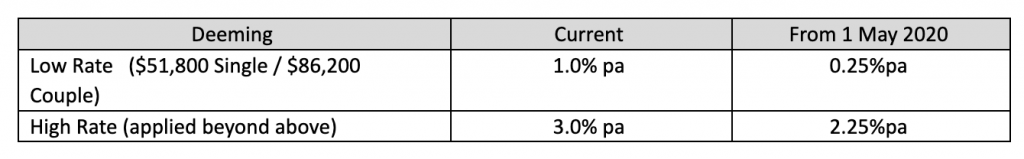

1. Reduction in deeming rates

A further reduction in deeming rates was announced on 22 March. The deeming rates will reduce as follows:

The deeming thresholds are unchanged at $51,800 (single) and $86,200 (couple) which are generally indexed on 1 July each year. The rates will take effect from 1 May 2020, and any additional entitlement as a result of the lower rates will be paid from that date.

2. Self-Funded Retirees & the Aged Pension

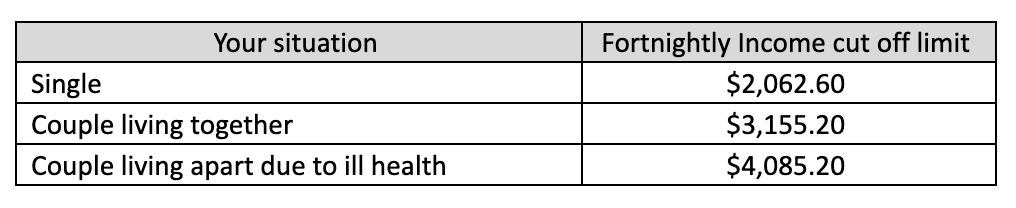

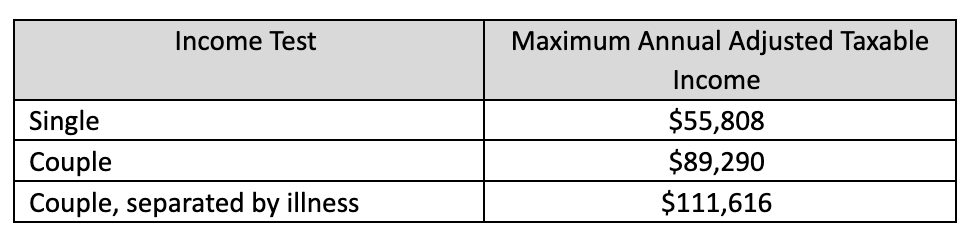

- If you are currently excluded from an Age Pension because your assessed income is too high (income test), from 1 May 2020 you may qualify if the lower deeming rates mean your assessed income falls below the following income threshold:

- Due to a significant fall in the value of investments over the past five weeks, your total assessable asset values (as assessed under the aged pension asset test rules) may have reduced to a level by which you could now qualify for an aged pension.

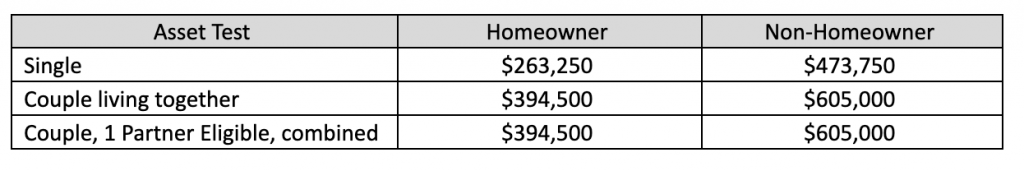

Asset test thresholds to be eligible for the full pension:

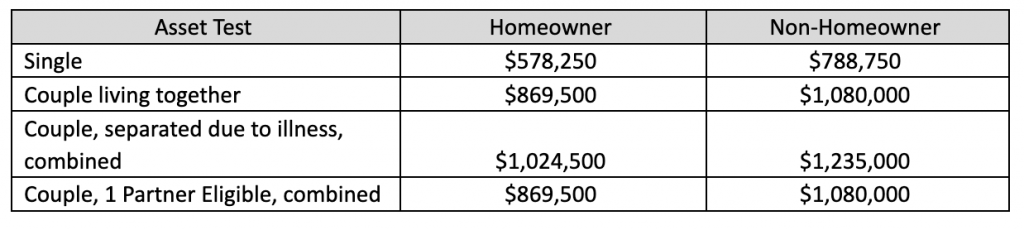

Maximum value of assets before eligibility for the aged pension cuts off:

- Commonwealth Seniors Health Card (CSHC)

Also, if you do not hold a CSHC due to your adjusted taxable income and deemed income on your superannuation or pension assets then it might be worth reviewing this to see (as a result of the reduction in asset values experienced to date and/or the lower deeming rates that will take effect from 1st May 2020) if you qualify for the CSHC either immediately or from 1 May.

The benefits associated with holding the CSHC include:

- Cheaper prescription medicines under the pharmaceutical benefits scheme

- bulk billing for Doctors’ visits

- bigger refunds when Medicare safety net reached

- State & Local Government may also offer discounts on council & water rates; gas and electricity charges; health care, public transport and stamp duty

To be eligible to receive a CSHC you must satisfy the income test. This requires that you earn no more than the following amounts:

3. Existing Aged Pension recipients

Due to the likelihood of the market valuation of your retirement assets falling over the past five weeks (assuming your investments have been exposed to share markets) you may choose to have your overall position reviewed at this time in order to determine if you are entitled to a higher pension or benefit as a result of lower asset values.

If you the asset test resulted in a higher fortnightly pension, you may be able to have your fortnightly aged pension payment increased. If your eligibility to the aged pension was based on the income test you may also be able to secure a small increase in entitlements now due to asset value falling (which in turn reduces the deemed income) and then a further increase as from 1 May when the lower deeming rates come into effect.

Please note that if you ask Centrelink to review of your superannuation or pension values, they have the right to review the entire file.

4. $550 per fortnight Coronavirus Supplement Payment

The Coronavirus supplement of $550 per fortnight will be paid to new and existing recipients of:

- JobSeeker Payment (Note: You cannot receive the JobKeeper payment $1,500 per fortnight through an employer and the JobSeeker payment)

- Youth Allowance (JobSeeker)

- Parenting Payment

- ABSTUDY

- Austudy

- Farm Household Allowance, and

- Special Benefit.

The supplement will be paid over the next six months and will be paid automatically with your ordinary fortnightly entitlement. It will be paid from 27 April.

5. Two Payments of $750

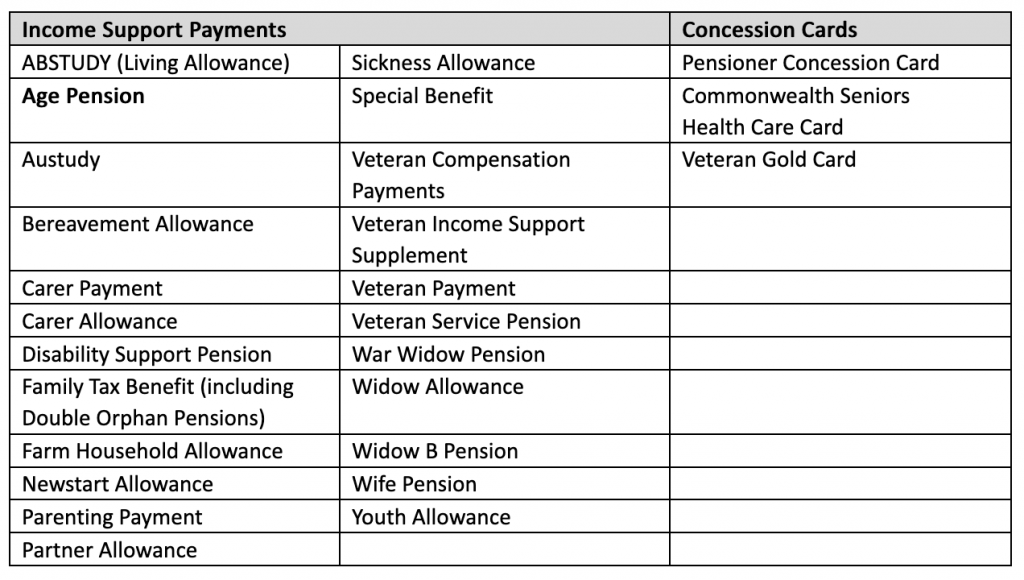

Two payments of $750 each will be paid to eligible income support recipients and concession card holders. The first tax-free payment is expected to be automatically paid to eligible recipients from 31 March 2020. The second payment will be available to those who aren’t eligible for the Coronavirus supplement (see below) and will be automatically paid from 13 July 2020.

Eligibility for payment one and payment two

To be eligible, you must be residing in Australia and have been eligible for one of the income support payments or a holder of one of the concession cards listed in the table below, on a day between 12 March and 13 April 2020. If you had applied for an eligible payment and are subsequently granted the payment, you will also be eligible for the one-off payment. These individuals will also be entitled to a second payment of $750 unless eligible for the Coronavirus supplement (see below).

6. Existing social security recipients (change in circumstances)

If you’re already receiving a particular benefit or payment and your circumstances change due to COVID-19, your benefit may remain unchanged. However, a change in circumstances that is not a result of COVID-19 will be assessed under the ordinary rules and may impact your entitlement. All changes should be reported to Centrelink or DVA within 14 days.

- Recipients of Carer Payment who are impacted will not have their benefits changed.

- Child Care Subsidy: if your child cannot attend childcare as a result of COVID-19, but you’re still charged a fee from your childcare provider, you may still receive the subsidy for up to 42 days of absence. This applies also to non-COVID-19 related absences. If your activity hours change, you don’t need to update your activity tests where it is due to a requirement to self-isolate, or if you’re on leave.

- Newstart or Jobseeker: Recipients with mutual obligations (for example Newstart or Jobseeker recipients who usually need to be actively looking for work, volunteering, or doing some paid work) will be provided flexible options to ensure your safety. This may apply where you’re unable to satisfy these requirements because you are self-isolating, or you’re a primary carer, caring for a child whose school has closed, or a disabled adult whose day service closes. You may receive an exemption from this requirement without a need for medical evidence.

- Youth Allowance (student): Activity requirements for study will be amended. This means that if you’re a student and you’re unable to attend studies due to the virus, you may be exempt from meeting this requirement.

- Students and trainees: If you’re self-isolating at home or your education provider closes or reduces your study load, your payment won’t change. You must remain enrolled in study and have a plan to return and must tell Centrelink if this doesn’t apply to you.

7. Applying for a New Benefit – impacted by COVID-19

Depending on your circumstances, you may be eligible to apply for a number of payments. You may have been stood down, made redundant, or have had your hours significantly reduced. It’s also possible that you’ve needed to stop working to care for someone.

Also, if you’re unable to work, are in isolation or hospital, or you need to care for children as a result of COVID-19, you may also be eligible to apply for a payment for a period of time.

Ordinarily, most benefits and concession cards have either an income test, and assets test, or both, to determine your eligibility. However, if you apply for a social security benefit or concession card and your claim is related to COVID-19, some of the ordinary eligibility rules may be waived for approximately six months. Also, if you’re an employee, and you are diagnosed with COVID-19 or are in isolation, you may be eligible for an income support payment if you are not also accessing employer leave entitlements, or income protection policy benefits.

If you’re a sole trader or you’re self-employed you may also be eligible for a payment if your business has been suspended or turnover has reduced significantly.

8. New category of Crisis Payment

Individuals claiming an income support payment may be eligible for a Crisis Payment under a proposed new category, if they are required to self-isolate at home due to the Coronavirus. At the time of claiming the Crisis Payment, a person must:

- have made a claim and qualify for an income support payment, and

- satisfy requirements of any legislative instruments made by the Minister, including the need to self-isolate.

The one-off Crisis Payment is tax-free and is equal to one week your income support payment (basic rate).

9. Waiting periods and assets testing

The ordinary one week waiting period that applies to some payments is waived when claiming because you are impacted by COVID-19. The Liquid Assets Waiting Period (LAWP) is also waived if you’re entitled to the Coronavirus Supplement. If you have already applied for a payment and are currently serving a LAWP, you will not need to serve the remainder of the waiting period. This also applies if you have applied for a payment which is eligible for the Coronavirus Supplement.

The Income Maintenance Period and Compensation Preclusion Periods continue to apply. This means that if you have received a redundancy payment or a lump sum amount of unused leave entitlements, you may not be eligible for a payment straight away.

The Assets Test is not applied when determining your entitlement to JobSeeker Payment, Youth Allowance (JobSeeker) and Parenting Payment for six months. The income test continues to apply and may reduce the amount of the payment you are eligible for. If you are a member of a couple, your partner’s income is taken into account when determining your eligibility. To access these measures, recipients of JobSeeker Allowance and Youth Allowance (JobSeeker) cannot be receiving employer benefits (such as sick leave or annual leave payments) or income protection payments at the same time.

Please refer to earlier releases in relation to payments for workers and/or businesses.

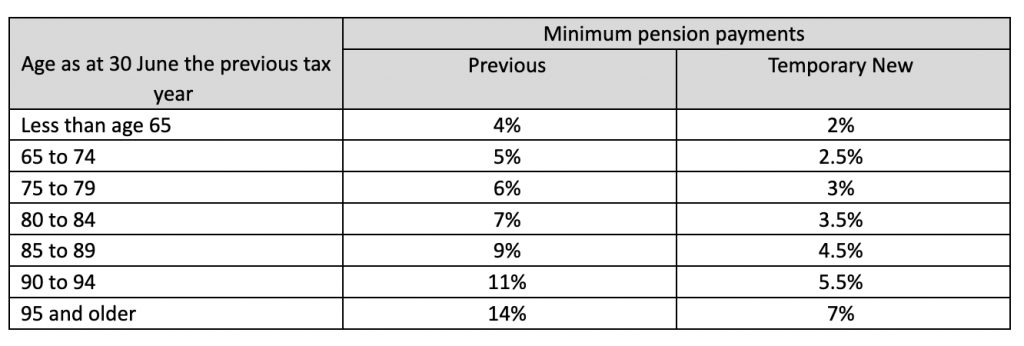

10. Income Stream (annuity and pension) drawdown rates

There is a temporary reduction in the minimum annual amount that you must withdraw each year from your account-based pensions. The reductions apply for the duration of the 2019/20 financial year and the 2020/21 financial year. Therefore, if you already have enough income (cash flow) and wish to reduce the pension from your tax-effective savings you may choose to lower your minimum payment as follows:

Should you have any queries in respect to the above or if you would like us to undertake a formal review of your circumstances to assess if you are eligible for any of the above benefits please do not hesitate to contact either Rodney Johnstone or Tom Weir on 03 96291433 to discuss.

The comments are closed.